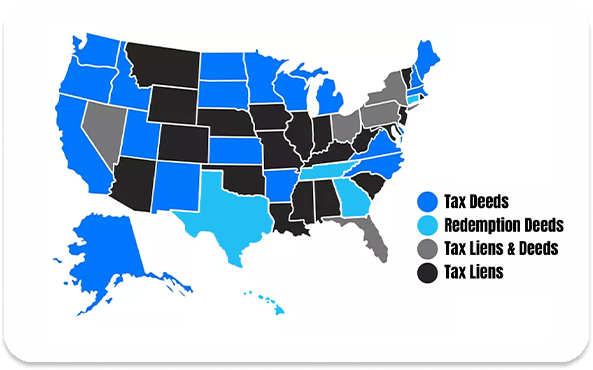

State laws determine how property taxes are issued and enforced. There are 3 different enforcement systems identified in state laws. Use the color key below to identify which system each state uses.

| STATE | TAX SALE TYPE | AUCTION DATES | INTEREST | REDEMPTION |

|---|---|---|---|---|

| Alabama | Tax Liens | Yearly in April-June | 12% | 3 years |

| Alaska | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Arizona | Tax Liens | Yearly in February | 16% | 3 years |

| Arkansas | Tax Deeds | June through October | N/A | 30-Day |

| California | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Colorado | Tax Liens | Yearly in Oct-Dec | 9%+Prime | 3 years |

| Connecticut | Redemption Deeds | Yearly (Anytime) | 18% | 6 Months |

| Delaware | Redemption Deeds | Yearly (Anytime) | 15% | 6 Months |

| Florida | Tax Liens & Deeds | Liens: May & Deeds: Monthly | 18% | 2 Years |

| Georgia | Redemption Deeds | Monthly | 20% | 1 Year |

| Hawaii | Redemption Deeds | Yearly in June or Nov-Dec | 12% | 1 Year |

| Idaho | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Illinois | Tax Liens & Deeds | Liens: Oct-Dec & Deeds: Varies | 18% | 2 or 3 years |

| Indiana | Tax Liens & Deeds | Liens: Aug-Oct & Deeds: Varies | 10% | 1 year |

| Iowa | Tax Liens | Yearly in June | 24% | 2 years |

| Kansas | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Kentucky | Tax Liens | Yearly in July-October | 12% | 1 Year |

| Louisiana | Redemption Deeds | Liens: May-June & Deeds: Monthly | 12% | 3 Years |

| Maine | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Maryland | Tax Liens | Varies; Majority May-June | 18% | 6 Months to 2 Years |

| Massachusetts | Redemption Deeds | Yearly (Anytime) | 16% | 6 Months |

| Michigan | Tax Deeds | July to November | N/A | NA |

| Minnesota | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Mississippi | Tax Liens | Yearly in August or April | 18% | 2 Years |

| Missouri | Tax Liens | Yearly in August | 10% | 1 Year |

| Montana | Tax Liens | Yearly mostly in July | 10% | 2 or 3 Years |

| Nebraska | Tax Liens | Yearly in March | 14% | 3 Years |

| Nevada | Tax Liens & Deeds | Yearly (Anytime) | 12% | NA |

| New Hampshire | Tax Deeds | Yearly (Anytime) | N/A | NA |

| New Jersey | Tax Liens | Yearly (Anytime) | 18% | 2 Years |

| New Mexico | Tax Deeds | Yearly (Anytime) | N/A | NA |

| New York | Tax Liens & Deeds | Yearly (Anytime) for both | 20% | NA |

| North Carolina | Tax Deeds | Yearly (Anytime) | N/A | NA |

| North Dakota | Tax Deeds | Yearly in November | N/A | NA |

| Ohio | Tax Liens & Deeds | Liens: Varies & Deeds: Monthly | 18% | 1 Year |

| Oklahoma | Tax Deeds | Yearly in June | N/A | N/A |

| Oregon | Tax Deeds | Yearly in Oct through Nov | N/A | NA |

| Pennsylvania | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Rhode Island | Redemption Deeds | Yearly (Anytime) | 16% | 1 Year |

| South Carolina | Tax Liens | Yearly in Oct-Dec | 12% | 1 Year |

| South Dakota | Tax Liens | Yearly in December | 10% | 3 or 4 Years |

| Tennessee | Redemption Deeds | Yearly (Anytime) | 12% | 1 Year |

| Texas | Redemption Deeds | Monthly | None | 6 Months to 2 Years |

| Utah | Tax Deeds | Yearly in May | N/A | NA |

| Vermont | Tax Liens | Yearly (Anytime) | 12% | 1 Year |

| Virginia | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Washington | Tax Deeds | Yearly (Anytime) | N/A | NA |

| West Virginia | Tax Liens & Tax Deeds | Liens: Nov & Deeds:Sept-Oct | 12% | 18 months |

| Wisconsin | Tax Deeds | Yearly (Anytime) | N/A | NA |

| Wyoming | Tax Liens | Yearly in July-Sept | 15% | 4 Years |